Frontiers | Practical Implementation of the Kelly Criterion: Optimal Growth Rate, Number of Trades, and Rebalancing Frequency for Equity Portfolios

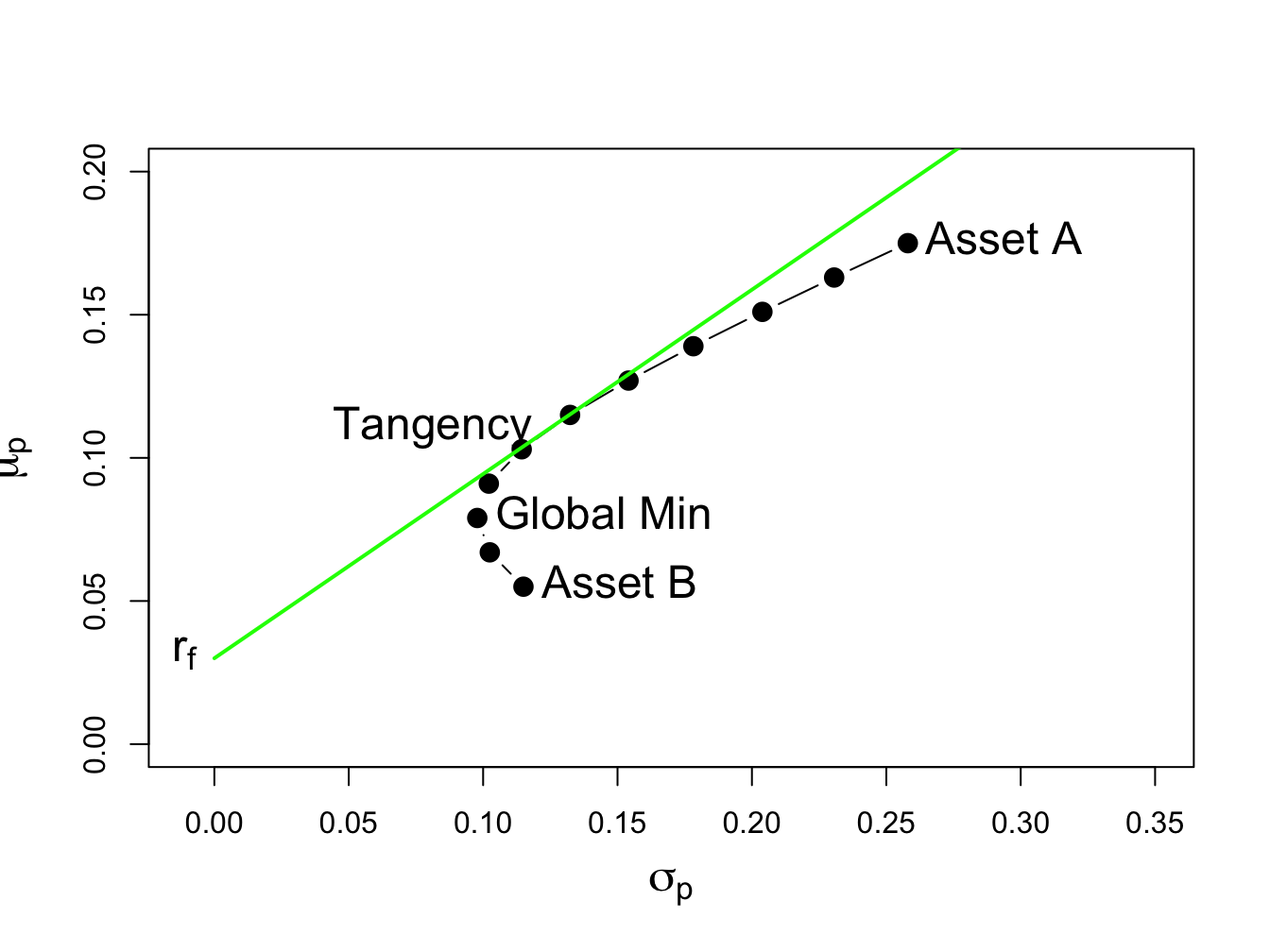

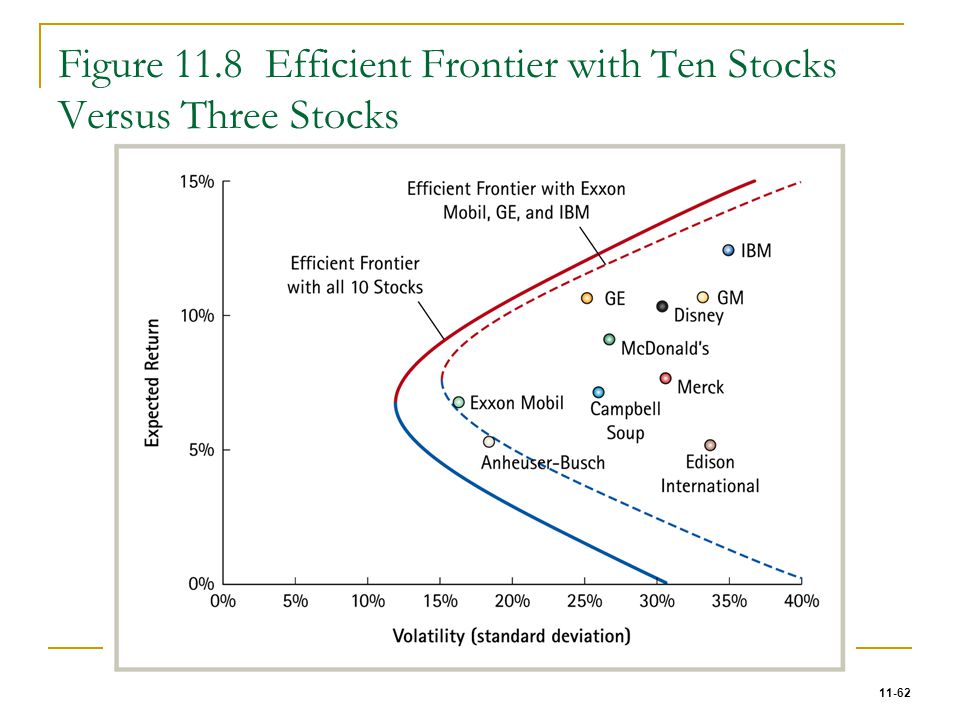

The efficient frontier for the ten assets with and without short sales... | Download Scientific Diagram

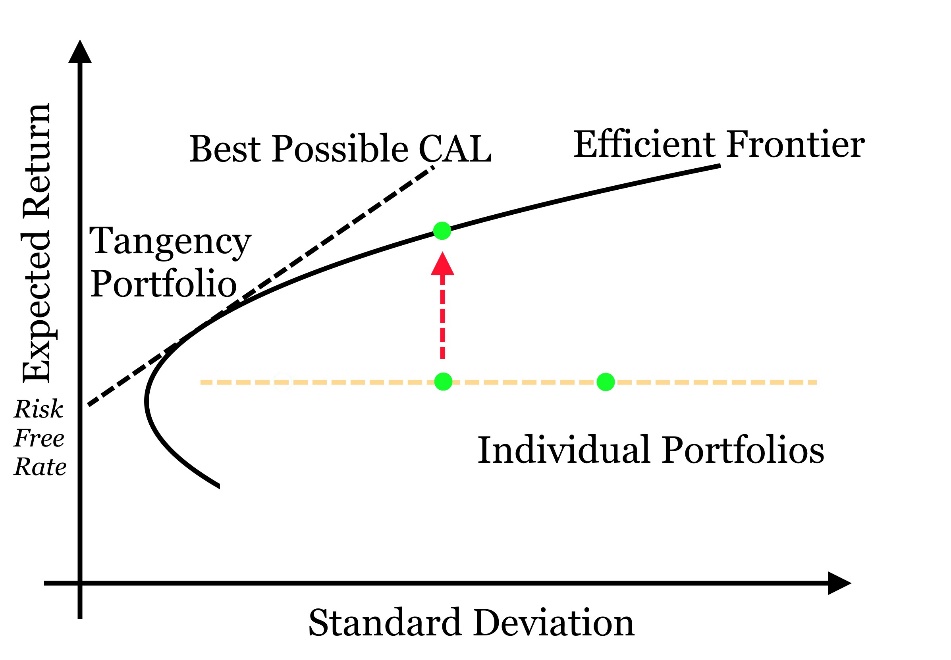

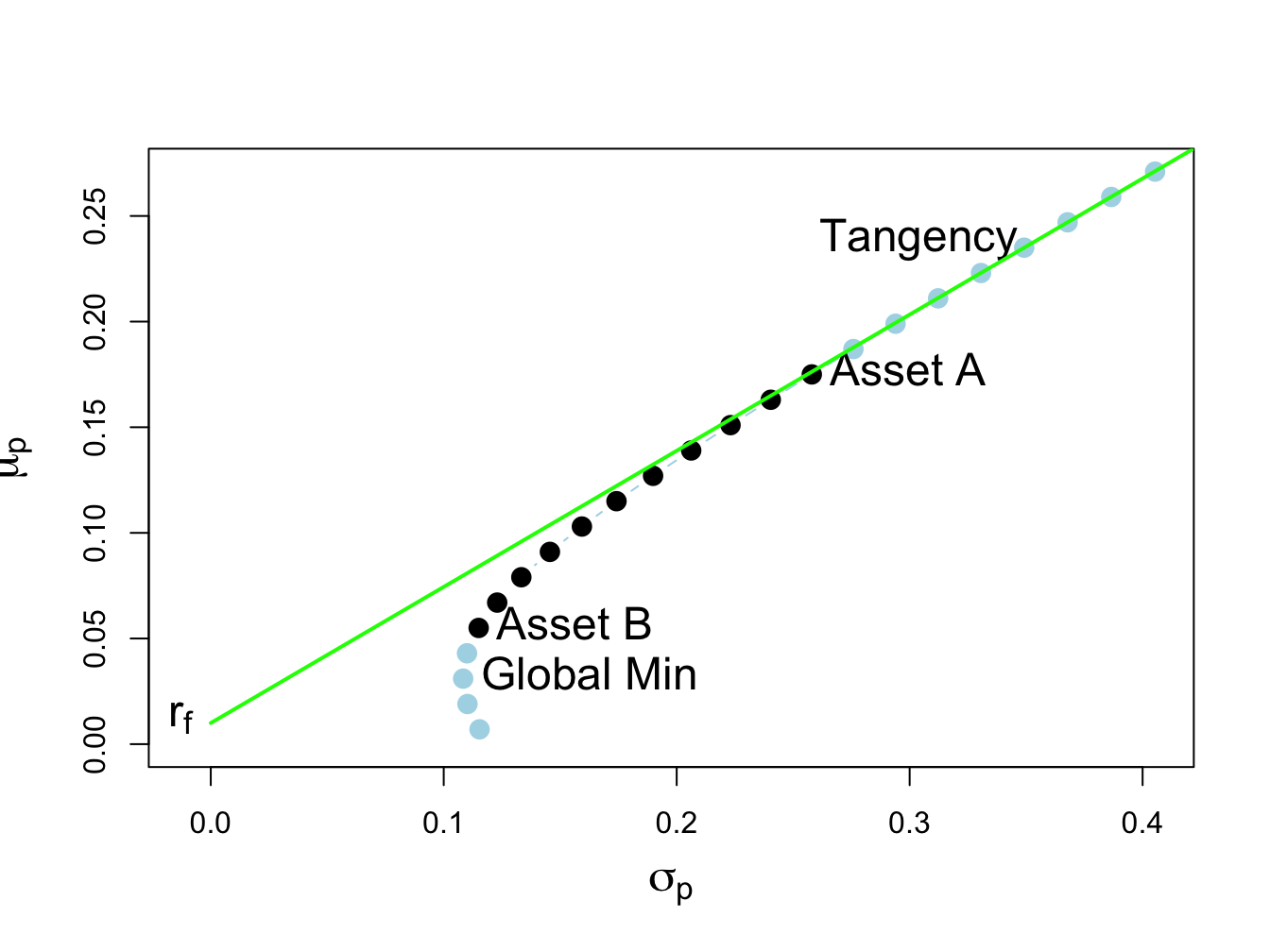

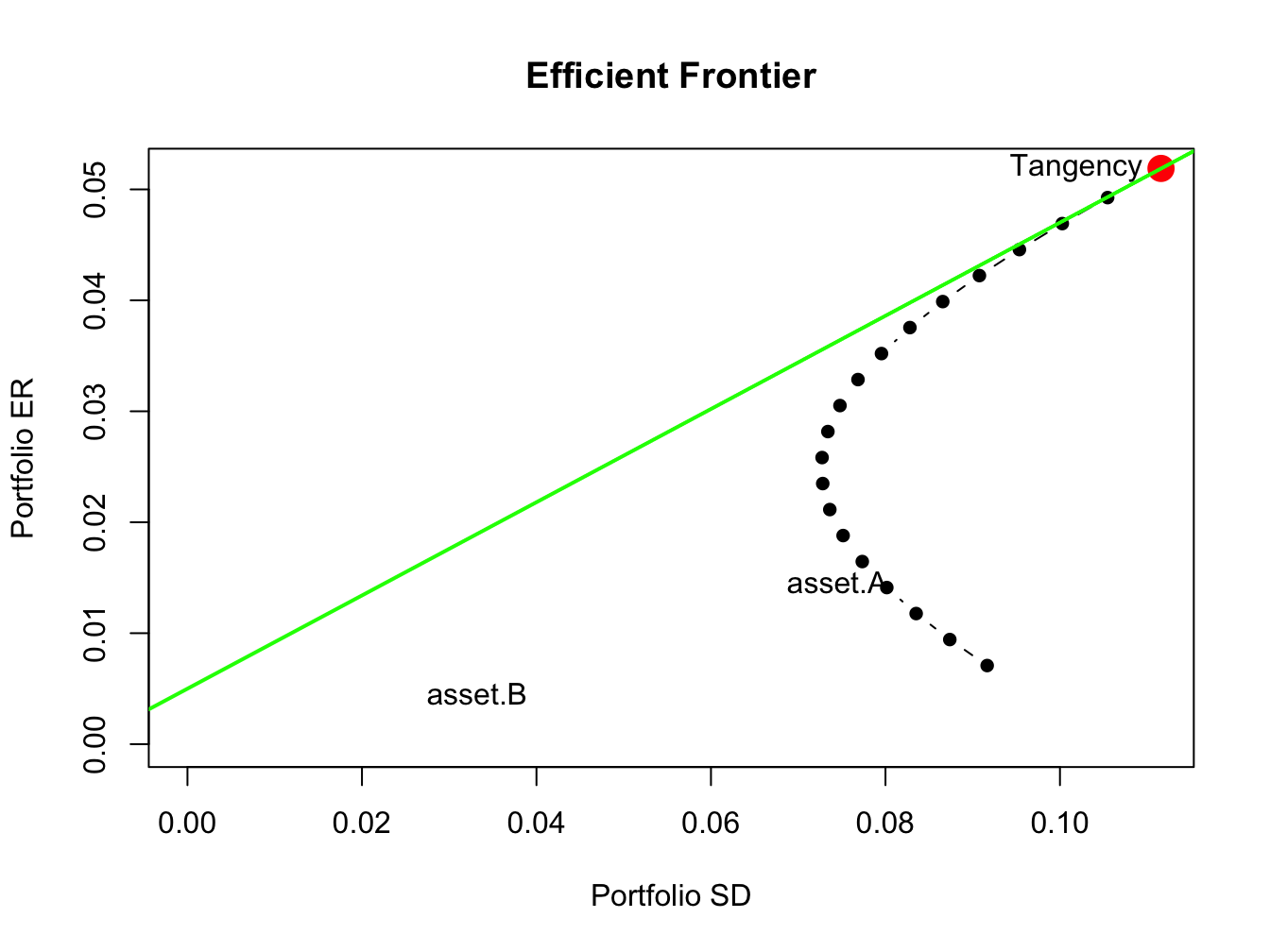

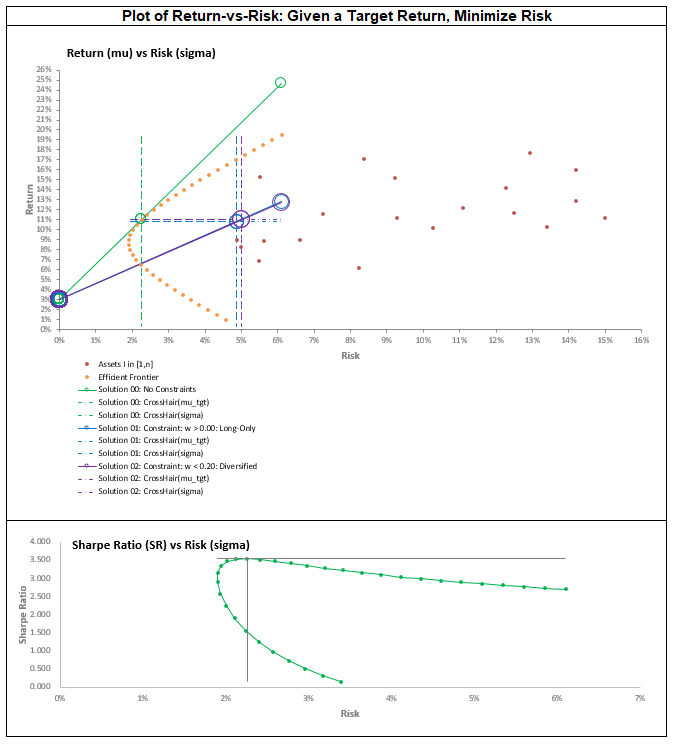

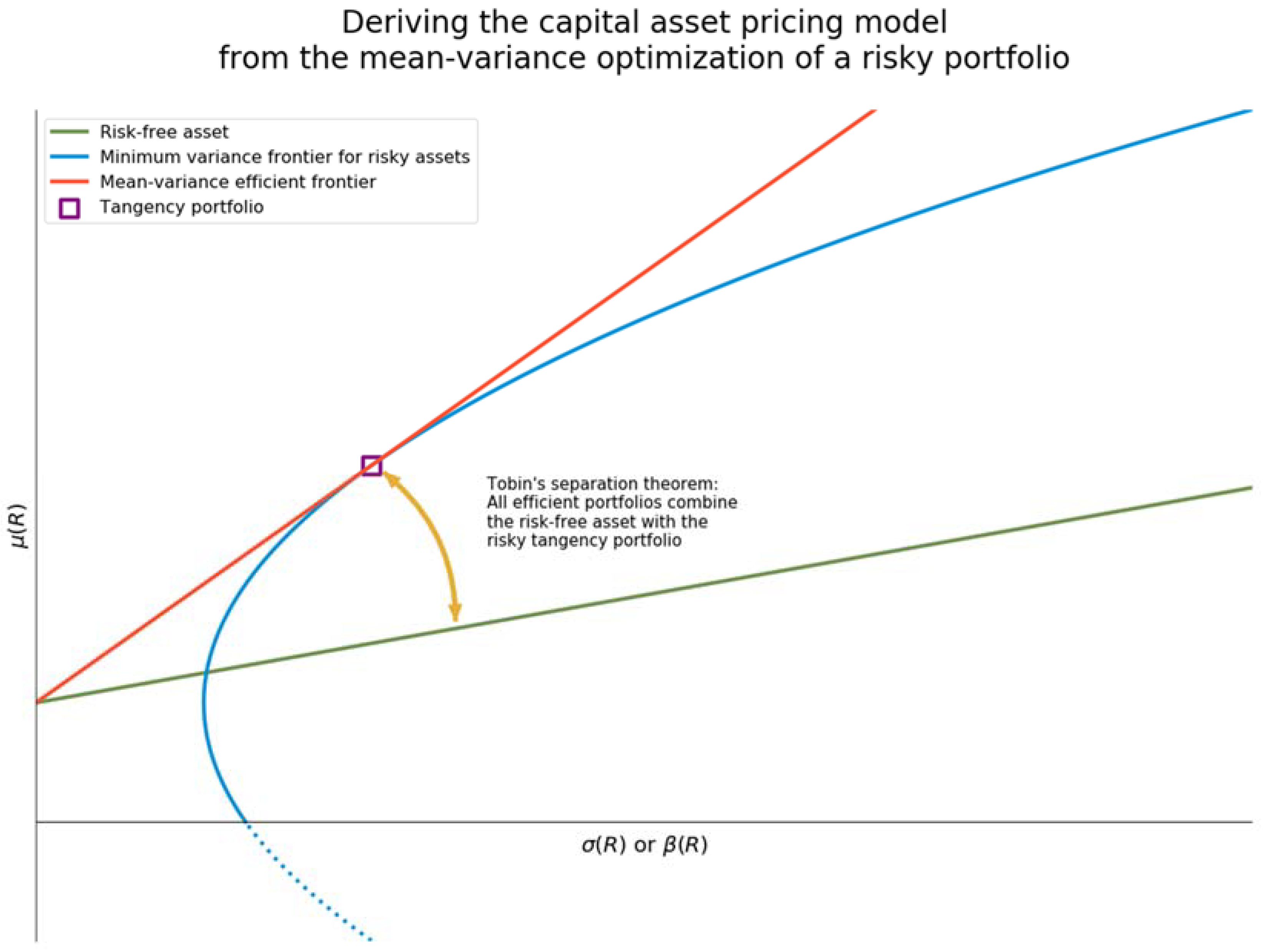

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

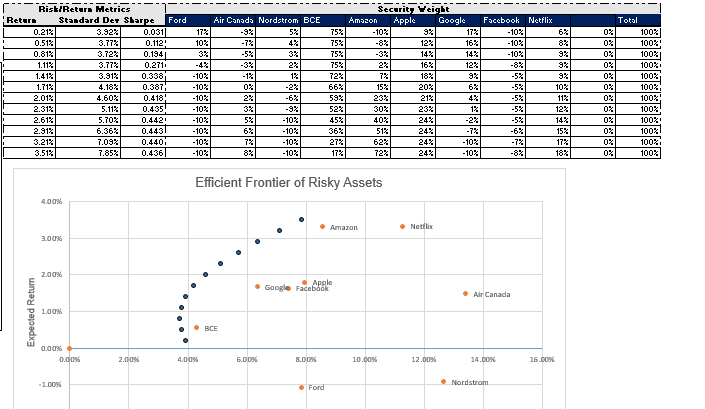

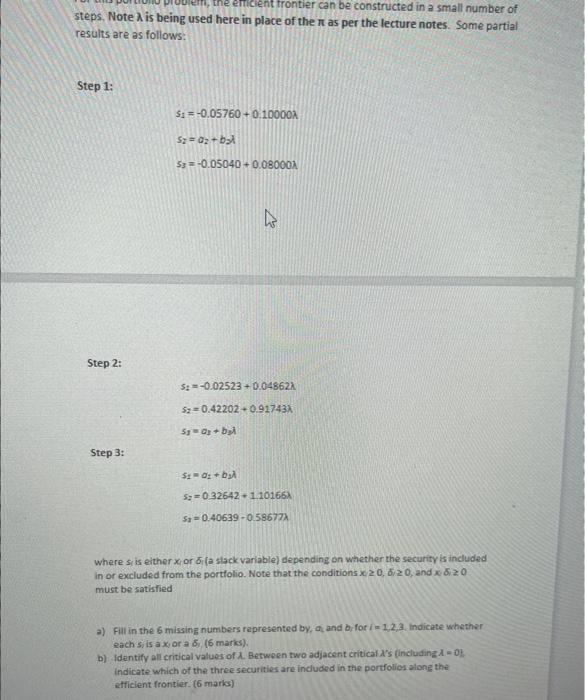

Quant Bible | Portfolio Optimization for 20 Securities Using Lagrange Multipliers, No Short-Selling, Weights Sum to 1

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

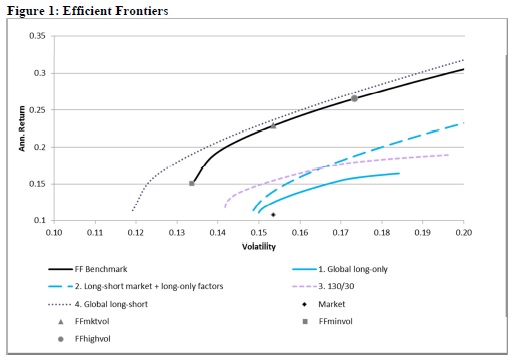

Economics 487 Homework #4 Solution Key Portfolio Calculations and the Markowitz Algorithm A. Excel Exercises: (10 points) 1. Dow

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)